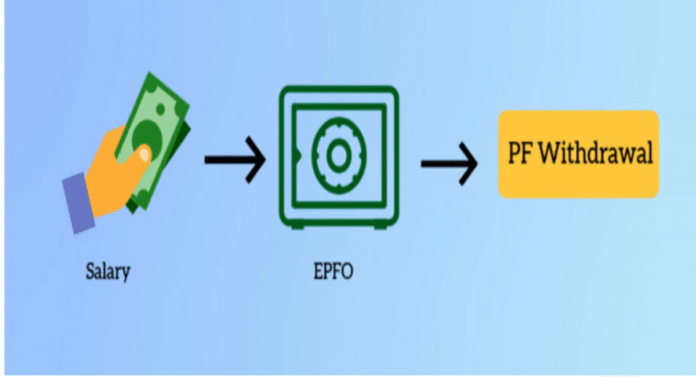

The Employees’ Provident Fund (EPF) serves as a savings and retirement scheme for salaried employees across India. It provides financial security post-retirement and acts as a safety net during challenging times, such as unemployment or medical emergencies. While earlier EPF withdrawals required the employer’s signature, advancements in digital technology have enabled EPF members to process the withdrawal online without depending on the employer. This article explores how to withdraw PF amount online without employer signature, with step-by-step instructions tailored for employees seeking greater autonomy over their EPF accounts.

Understanding the EPF Withdrawal Process Without Employer Signature

Why Employer Signature Is No Longer Needed?

Previously, employees had to route their EPF withdrawal requests through their employers, which involved physical paperwork and delays. However, with the introduction of online facilities by the Employees’ Provident Fund Organization (EPFO), employees can now initiate the process directly on the Unified Member Portal without requiring the employer’s intervention.

This method leverages technological provisions such as Aadhaar linking, Universal Account Numbers (UAN), bank account verification, and digital authentication. These modern features make the withdrawal process seamless while ensuring safety and transparency.

How to Withdraw PF Amount Online Without Employer Signature

EPFO’s online service allows members to initiate the withdrawal process through their UAN portal. The steps are as follows:

1. Ensure Eligibility for Online PF Withdrawal

To withdraw your PF online without the employer’s signature, you must meet the following criteria:

– Your UAN (Universal Account Number) should be activated and linked to your Aadhaar card.

– Your Aadhaar and UAN should be verified with the correct mobile number.

– Your bank account details must be updated in the EPFO records.

– Your KYC (Know Your Customer) details should be approved in EPFO’s system.

2. Log in to the Unified Member Portal

Visit the Unified Member Portal and log in using your UAN and password. If you have not activated your UAN, you must first complete the activation process.

3. Navigate to ‘Online Services’

After logging in, select ‘Online Services’ from the menu bar. Then, click on ‘Claim (Form-31, 19 & 10C)’ to access the claim page.

4. Verify Your Personal Information

Ensure that your personal details, such as Aadhaar, PAN, and bank account number, are correct and updated. If any errors are noticed, update them in the portal through the appropriate section.

5. Select the Type of Withdrawal

You will be prompted to select the type of withdrawal, depending on your eligibility and purpose:

– Provident Fund Final Settlement (Form-19): For withdrawing the entire PF corpus when leaving employment.

– PF Pension Withdrawal (Form-10C): For withdrawing pension contributions.

– Partial Withdrawal (Form-31): For specific purposes such as medical emergencies, repayment of home loans, or marriage expenses.

Choose the appropriate form type based on your need.

6. Fill Out the Claim Form

Enter necessary information, including purpose, amount to be withdrawn, and other details. Ensure that all fields are accurately filled out to avoid rejection.

7. Upload Supporting Documents (if applicable)

For certain categories of withdrawal, such as housing or medical expenses, you may need to upload supporting documents. Ensure that scanned copies are clear and meet EPFO’s specifications.

8. Submit the Application and Await Approval

Once you’ve completed the form, submit the claim application online. After submission, you’ll receive an acknowledgment. The EPFO processes claims without requiring physical signatures. If all details are verified, the final settlement or withdrawal amount is credited directly to your registered bank account within a few working days.

How to Know PF Account Number?

While the EPF withdrawal process now revolves around UAN, knowing your PF account number is still essential as it links your contributions and service details to your employer. If you are wondering how to know PF account number, here’s how you can find it:

- Check Your Salary Slip: Most employers provide the PF account number in salary slips, typically listed under the deductions section.

- Log in to the UAN Member Portal: Visit the Unified Member Portal. After logging in, you can view your PF member ID linked to your UAN under the ‘View-> Service History’ section.

- Ask Your Employer: Contact your HR department to disclose your PF account number.

- Check the EPFO Passbook: Download your E-Passbook from the official EPFO portal to view details of your PF contributions and PF account number.

Your PF account number, alongside your UAN, is crucial for any EPF-related activities such as withdrawals, transfers, and account validation.

Calculations for PF Withdrawal

The calculation for PF withdrawal depends on several factors, including account balance and eligibility. Let’s illustrate the calculations with an example:

Example:

Assume the following:

– Total Employee Contribution = ₹2,00,000

– Total Employer Contribution = ₹1,50,000

– Pension Contribution (Employer Share) = ₹50,000

If you’re withdrawing through Form-19 (Final Settlement) due to retirement, the full corpus will be credited:

Total PF Amount = Employee Contribution + Employer Contribution

= ₹2,00,000 + ₹1,50,000

= ₹3,50,000

If you’re withdrawing partially through Form-31, say, for medical emergencies:

Eligibility for Medical Emergency = 6 months’ basic wages or employee share (whichever is lower)

Basic Wage = ₹25,000/month

Eligibility (6 months’ basic) = ₹25,000 × 6 = ₹1,50,000

Amount to be withdrawn is capped at ₹1,50,000.

Disclaimer:

The Indian financial markets involve inherent risks, including uncertainties in economic situations and regulatory changes. Investors are advised to thoroughly analyze the pros and cons of engaging in EPF withdrawals before making decisions. They should tailor their choices to meet their financial objectives without relying solely on assumptions.

Summary:

The ability to withdraw Provident Fund (PF) amounts online without an employer signature has liberated employees from cumbersome bureaucracy and delays. By leveraging the EPFO’s Unified Member Portal, employees can submit withdrawal claims directly using their UAN credentials. Key prerequisites include Aadhaar linking, bank account verification, and updated KYC details. The process involves logging into the portal, choosing the appropriate withdrawal type, verifying details, and submitting the claim. Once approved, funds are disbursed into the registered bank account within a few business days.

Employees can also retrieve their PF account numbers by checking their salary slip, UAN portal, or EPFO passbook. PF withdrawal calculations vary based on the type of withdrawal, purpose, and account balance. While the streamlined facility eliminates the need for an employer’s signature, employees must carefully assess their financial standings and long-term goals before proceeding with a withdrawal.

This facility ensures flexibility and convenience for employees, especially during emergencies or after changing jobs. However, one must bear in mind the risks involved in prematurely using retirement savings.